Economic Schools of Thought: Labour Perspectives

-

Overview6 Topics

-

Background information10 Topics

-

Endnotes

-

References

-

Interactive learningDeepen your knowledge2 Quizzes

-

Training materialExercises2 Topics

Adam Smith

Adam Smith

The Wealth of Nations (1776) is the book that made Smith famous and established him as the Father of Economics. The content of the book is truly revolutionary if we take into account that it was written during a time period in which feudalism was still widespread and also quite strong, and that the part of the economy that was organised according to the market mechanism was extremely small, albeit rapidly growing. In fact, Smith’s contribution is located precisely in the final stage of the transition from a mediaeval and feudal society into the modern and capitalist one. More specifically, it is usually identified at the end of the 18th century, especially when it comes to England (and, by extension, Scotland), with the beginning of the industrial revolution.

At the level of production processes it was manufacturing production that gave impetus to the consolidation of two of the social classes characteristic of modern society: the industrial capitalists, on the one hand, and the industrial proletariat, on the other. Nevertheless, despite its fully modern features (such as the new productive modalities in the labour fragmentation and specialisation) the manufacturing production that Smith witnessed was far from mature. The industrial revolution had recently started but was still unfinished.

The categorical break that Smith produced in the defence of the nascent capitalist system must be considered, more than anything, as a reaction and a critique of traditional, mediaeval, feudal and absolutist systems that governed until that time. Smith’s intentions to discover the laws that ruled the new modern society definitely broke with the scholastic tradition fundamentally permeated by theology; while also rejecting some of the main propositions of the two economic currents that date from the immediately preceding centuries and that also belong to modernity: Mercantilism and the Physiocratic school. In other words, beyond Smith’s class membership, modern society’s apology can be interpreted as a result of its rejection of the hegemonic traditions of the time.

The first great question that Smith pursued was to reveal the mechanism through which a social system of the type outlined above would function over time and remain stable. In the next section we touch upon some of the ideas and the “economic laws” that Smith used as arguments in defence of the new social regime from a “scientific” perspective.

The invisible hand

By introducing the notion of economic laws and their operation, Smith placed economics on a scientific foundation. This is the reason why he is called the founding father of modern economics. In concrete, Smith intends to show that the economic forms of the capitalist system, not being governed by traditional principles and norms, meaning by feudal regulations and restrictions, do not lead to a general disorganisation but, on the contrary, capitalism is governed by a set of laws that ensure the material reproduction of society and, furthermore, its progress. However, these laws have a particular nature.

First, Smith outright dismisses any immediate link between economic laws and divine laws. On the contrary, economic laws refer to a purely human phenomena, and more specifically to the self-interest of humans. Smith argues that self-interest, a socially unacceptable motive, gives rise, via complex social interrelations, to social cohesion and to growth. Considered from a strictly individual perspective, if a certain way of acting is more profitable or satisfactory, and the same happens with each one of the individuals that make up society, then, by virtue of that individual convenience, such behaviour and its results are the ones that will be imposed as general economic laws. Smith described this spontaneous operation of objective laws that guide human action in a way that accords to the interests of society as a whole as the invisible hand.

While one would expect that self-interest would lead to a chaotic society, Smith instead argues that society does not collapse thanks to competition. When each and every member of the society seeks to serve his or her own interest, without regard for social costs, his or her interest confronts with those of other similarly motivated individuals. If, for example, a producer charges a too-high price, then it is expected that the buyers will turn to other producers. If a producer underpays his workers, workers will seek employment elsewhere.

In addition, this system is based primarily on decentralised decisions of numerous individuals without the mediation of any central coordinating agency but only under the coordination of the market mechanisms that solve the problem of production. For example, if the price of a product is too high, this is an indication that society wants larger quantities of that product. High prices give rise to excess profits, which attract investment in this profitable activity; this accumulation of capital expands the supply of the product, something that society wanted in the first place and at lower prices. The converse process takes place in the case where the price is below normal. In the same line, the problem of distribution is implicitly solved, since the prices of the products incorporate the normal rewards of the factors of production, that is, normal wages, profits and rents.

In short, Adam Smith grounded his theory in the entwining notions of self-interest and competition which led by the invisible hand explain how the market mechanism is a self-regulated system, whose operation does not lead to chaos and to eventual breakdown, but rather to a system that manages to give rise to social cohesion and to hold together all centrifugal forces.

Division of labour

In The Wealth of Nations, Smith’s search for understanding of the new dynamics of the ‘civilised society’, that is to say, of the nascent capitalism whose birth he was witnessing, is an intention to find an answer to the natural follow-on question: “what is wealth?”. In fact, Smith’s responses showed immediately, since in the first sentence that appears in the book’s introduction he makes a brief statement that arguably would become the cornerstone of the entire classical theoretical system:

“The annual labour of each Nation is the fund that in principle provides it with all the things necessary and convenient for life, and that the country consumes annually. Said fund is always integrated, either with the immediate product of labour, or with what is purchased through said product from other nations.”(WN [1776] p. 3).

Briefly, almost laconically, Smith brings essentially different two points of view from the two most important theories of his time. In the first place, he maintains that wealth is made up of goods, of products of all kinds – the “necessary and convenient things for life”. And secondly, and even more importantly, he asserts that the sole and exclusive source of wealth is men’s labour, or more precisely, the labour of the society taken as a whole – the “annual labour of the nation”. He explicitly rejects mercantilist ideas that argued the origin of wealth should be sought in commercial operations and its preferential form is money; as the belief of the mercantilists stated. But neither is it created solely by agricultural work nor does it take shape exclusively in the primary products generated by nature and which will then undergo various transformations, as was defended by the Physiocratic version.

Continuing with this reflection, if it was true what Smith maintains – that is, that wealth is made up of things necessary and convenient for life and whose origin is labour, the next question that the author tried to answer was “how could a society increase wealth?”. Smith’s argument was a direct follow-on from the above, as he stated that the natural tendency of the market economy is the growth of wealth that is created from the division of labour with its consequent increase in productivity and reduction in cost. Here again, it is important to remember that Smith was describing an economy in transition from feudalism to the market system. Smith’s time is characterised by the diffusion of manufacturing production and not by the appearance of the modern factory and its technological innovations. This implies that the increase in the volume of production should be unequivocally attributed to a growth in the “productive powers of labour”, since it was not associated with either a substantial increase in the working population or the use of new machinery to assist the worker in his tasks. The cause of the increase of labour productivity must be then sought, according to Smith, in the deepening of the division of labour.

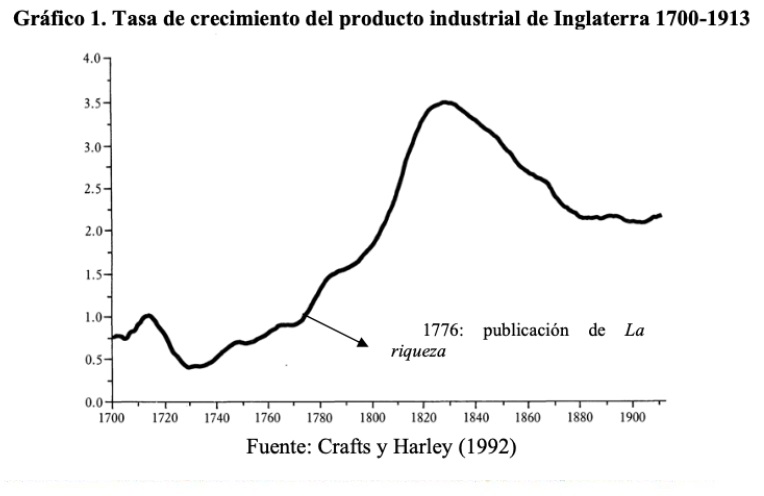

Graph: the growth of industrial production in England 1700-1913

With the purpose of explaining the division of labour, for which Smith uses the famous analogy of the pin factory, he explains that when the production process aimed at the manufacture of the same article is fragmented into numerous simple operations performed by different workers, an increase in labour productivity takes place for three reasons: First of all, the specialisation of the worker in a single repetitive task gives him greater dexterity; secondly, there is a saving of the “downtime” caused by the passage from one operation to another; and finally, by dedicating the whole day to a single task, the worker’s creativity is stimulated, which helps you to devise new and more effective tools of work or to improve old ones.

This labour division theory adds two important elements. First, although the market society functions in a completely decentralised way, where each individual seeks to satisfy his own self-interest, yet this society creates internal mechanisms that bind people together in a cohesive totality. Far from establishing total independence among producers, a relationship of mutual dependence, of a new type, is established among all men: “in a civilised society – Smith says– [every man] needs the cooperation and assistance of the crowd at every moment “(WN [1776] p. 16). Secondly, Smith demonstrated that such a society is capable of economic growth, as the division of labour unquestionably leads to a rapid increase in productivity, which in turn leads to the growth of the economy. The next question is whether this growth of the economy will continue forever, an issue that Smith relates with the supply and demand of labour and its price, for which we need to understand Smith’s theory of value more in depth.

Theory(ies) of value

It has already been established that civilised society is in its essence a commercial society, in which, as a result of the division of labour, each man specialises in a form of production and is therefore obliged to resort to the product of other men’s labour through exchange. The line of argument drawn in the Wealth of Nations leads to the discussion about the forces that govern exchange relations, that is, the determination of the value of commodities.

The theory of value is the effort to connect the surface phenomena of economic life to some inner law. Smith affirms that the word VALUE has two different meanings, since sometimes it expresses the utility of a particular object value, and, at other times, the ability to buy other goods. We can call the first use value and the second exchange value. The starting point of the investigation is precisely the question: how is the relative value or exchange value of goods determined? What Smith said is that exchange value is not quantitatively conditioned by use value (by utility), and that the magnitude of use value and exchange value are two independent factors of the commodity.

Smith argued in the first three chapters that labour is socially divided in such a way that for the owner of a commodity – dependent on the labour of others to obtain things necessary and convenient for life – the value of his commodity is equal to work of others that your merchandise allows you to acquire or “command” in the exchange. According to Smith, when an individual exchanges one commodity for another, he is actually acquiring someone else’s work “embodied” in that product. Therefore, the value is, essentially, labour, and its magnitude is fixed by the amount of needed work. Nevertheless, here he faces one of the many difficulties in the race for discovering the real meaning of value. As much as it maintains that labour is the only true source of value, the truth is that labour cannot be observed by itself, which leaves a second question: how is this labour measured?

The simplest way to guarantee the result would be that the individuals involved in the exchange knew the quantities of labour contained in the commodities. For that, Smith takes the radical approach of describing a primitive society in which there is neither capital nor wage labour and where the worker-producer knows exactly the amount of work that each product of this society involves:

In the primitive and crude state of society, which precedes the accumulation of capital and the appropriation of land, the only circumstance that can serve as a norm for the reciprocal exchange of different objects seems to be the proportion between the different amounts of labour that it is needed to acquire them. If in a nation of hunters, for example, it usually costs twice as much to kill a beaver as it does a deer, the beaver will be naturally exchanged for or be worth two deer. It is natural that generally the product of the work of two days or two hours is worth twice that which is the consequence of a day or an hour (WN [1776] 1997: 47)

So in this context the law of value based on labour is fulfilled. Smith thus achieves his goal, only that he does it at the cost of making the law of value lose all its theoretical interest, since it would be a law that describes the behaviour of prices only in primitive society. What is, then, the law that governs exchange – the value exchange – in today’s “civilised society”? To answer this question, Smith had to abandon the labour theory of value and proposed a completely new and different explanation, known as the adding-up theory of value, which maintains that the exchange value is determined by the sum of wages, profits and income, that is to say, the rewards obtained by all those who participate in the production process: workers, capitalists, landowners. This theory of value, known as well as the “theory of production costs”, in fact, constituted a theory of price determination based on the cost of production, which was to play an important role in our days. This notion of value became the starting point for the development of theories of value that place labour, capital and land as equivalent factors of production and creators of value. This interpretation was supported by many economists of the nineteenth century, who include J.B. Say and J.S. Mill.

Ricardo, as we will examine in the next chapter, adopted Smith’s first view of value known as the labour theory of value and made an effort to apply it to modern society and solved some of the riddles that made Smith abandon his first (and correct according to Ricardo) view.